Good start to the new year with impressive January car sales figures

By H&H Admin

An increase in the cost of living at the start of 2022 did not discourage South Africans from buying new vehicles during January.

South Africans were faced with fuel price hikes and another increase in interest rates as the new year started, but that didn’t deter them from buying new vehicles during January.

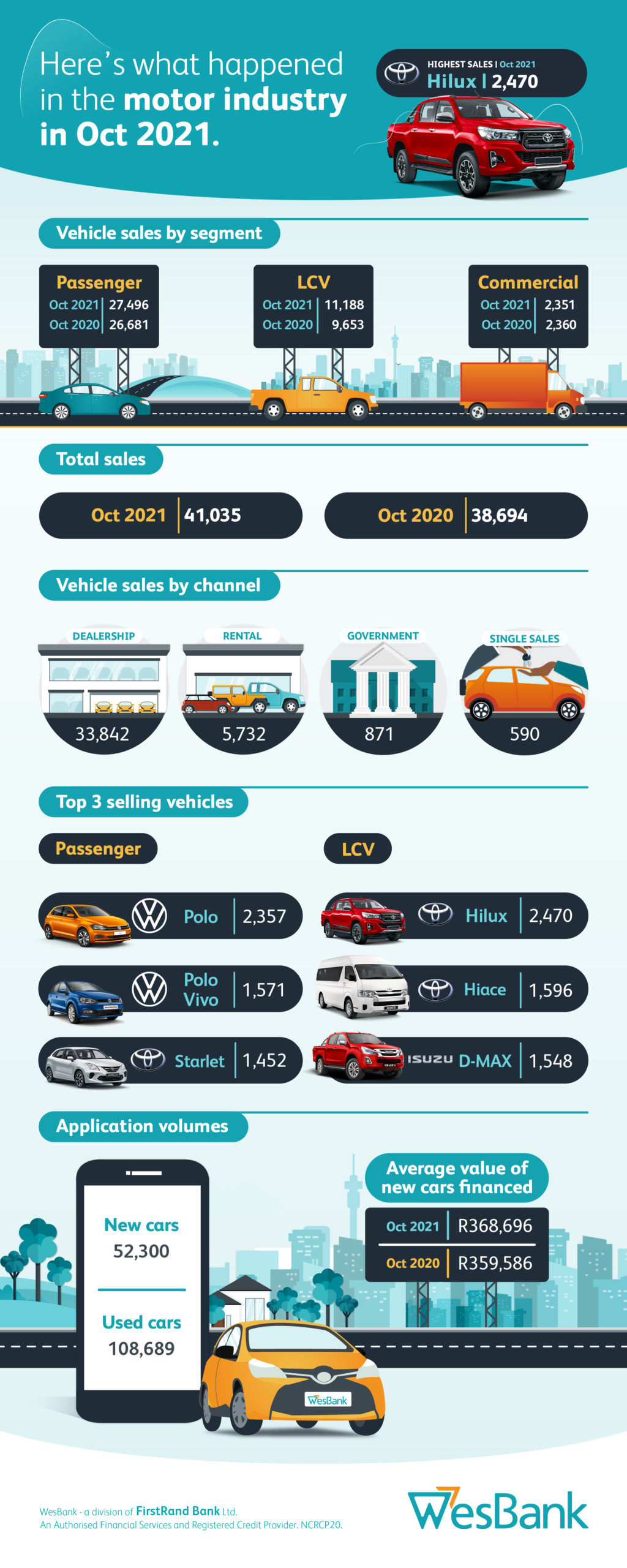

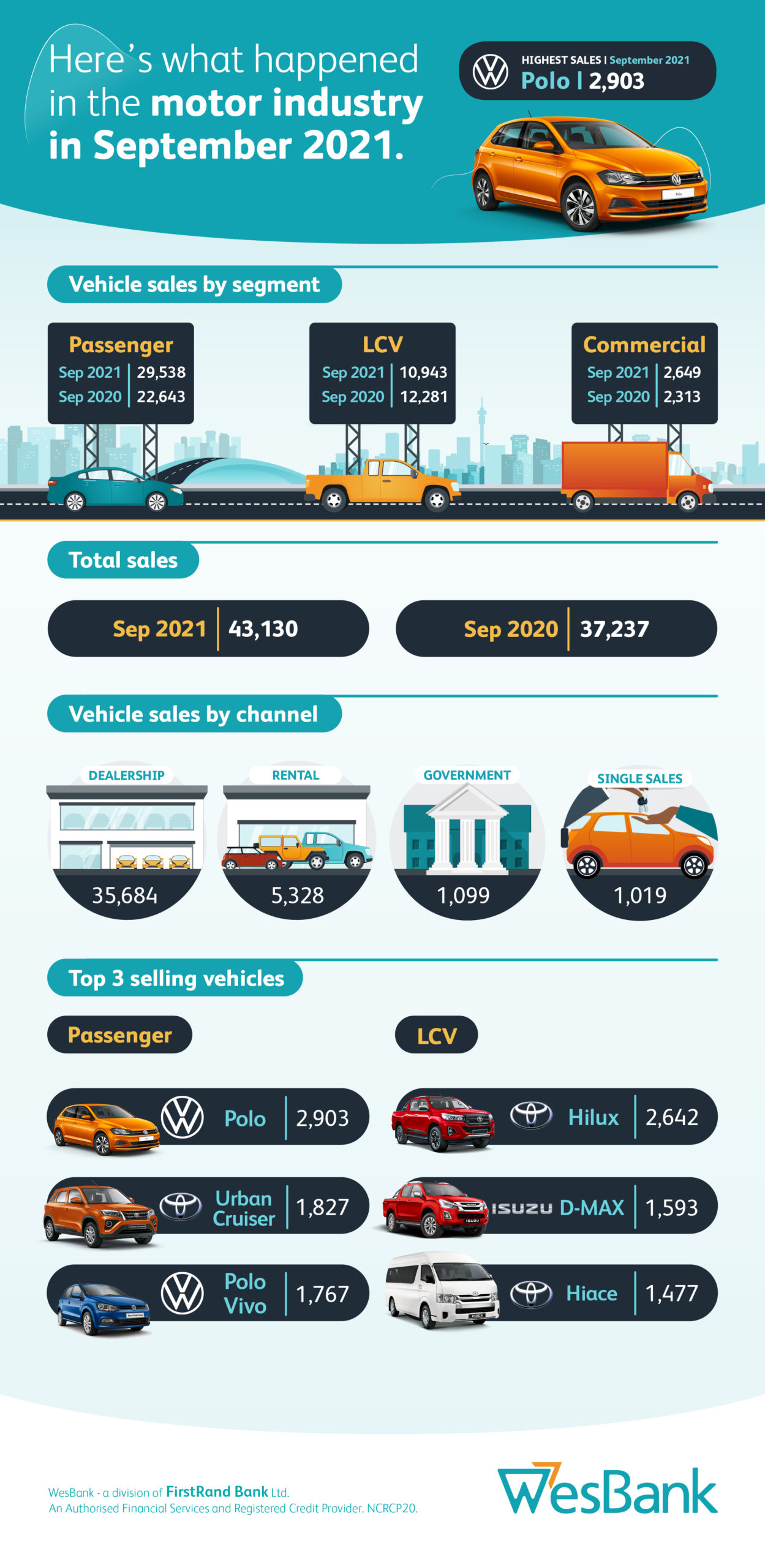

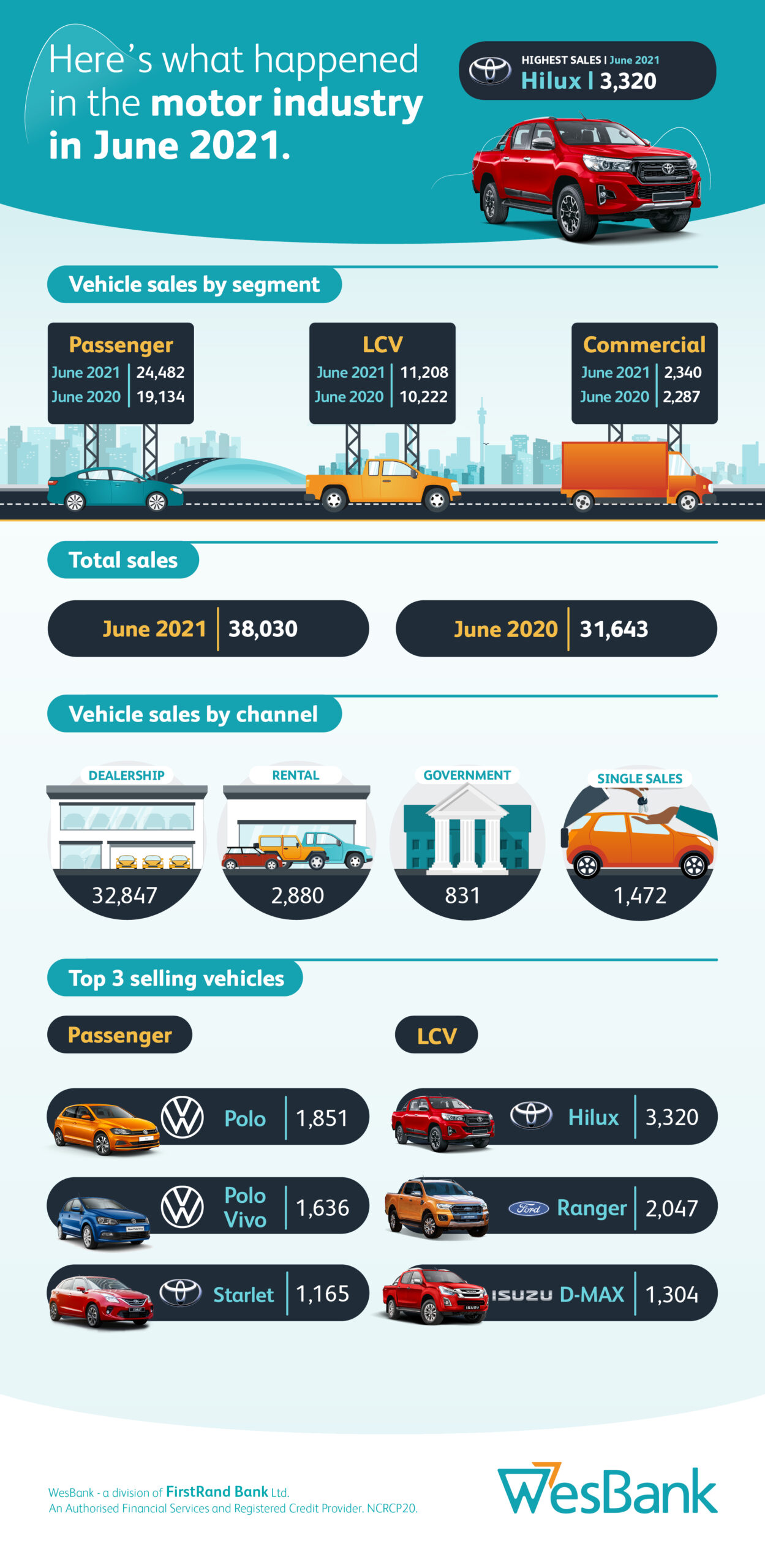

According to naamsa | the Automotive Business Council, January new vehicle sales increased 19.5% to 41,382 units compared to the start of 2021, creating a solid start to the year and the market’s continued recovery.

“January new vehicle sales kicked off the year at similar levels to the momentum created during the second half of 2021,” says Lebogang Gaoaketse, Head of Marketing and Communications at WesBank, referring to four months of sales in the period exceeding 41,000 units. “While some purchase decisions may have been deferred out of December into the new year, January sales provide a solid start to the year, raising the hopes of manufacturers and dealers for ongoing market improvement.”

While year-on-year comparisons remain difficult to interpret because of differing pandemic circumstances, WesBank remained positive for a continued slow recovery of the market during 2022.

Both passenger cars and light commercial vehicles (LCVs) started the year positively, increasing 26.6% and 3.8% respectively. Dealer sales in the passenger car space out-stripped the overall market, increasing 33.7%, a very positive sign of consumer demand.

Sales into the rental market also indicate an increase in business confidence and a more positive outlook to tourism with sales in the channel up 21% during January.

“While gradual interest rate hikes are inevitable over the course of the year from their record lows, their impact should be considered within purchase decisions and affordability,” says Gaoaketse. “Rising costs of living amidst more slowly recovering earnings are expected to continue placing pressure on household incomes and the wherewithal for consumers to afford new vehicles during 2022. But price inflation in the pre-owned market and necessary replacement cycles some two years after the onset of the pandemic should be expected to fuel demand.”