The new vehicle market continued to recover some momentum during September following the disruptions experienced in the economy during July. Building on August sales successes, September sales continued to capture reassuring consumer demand and provided some reassurance for a stronger final quarter.

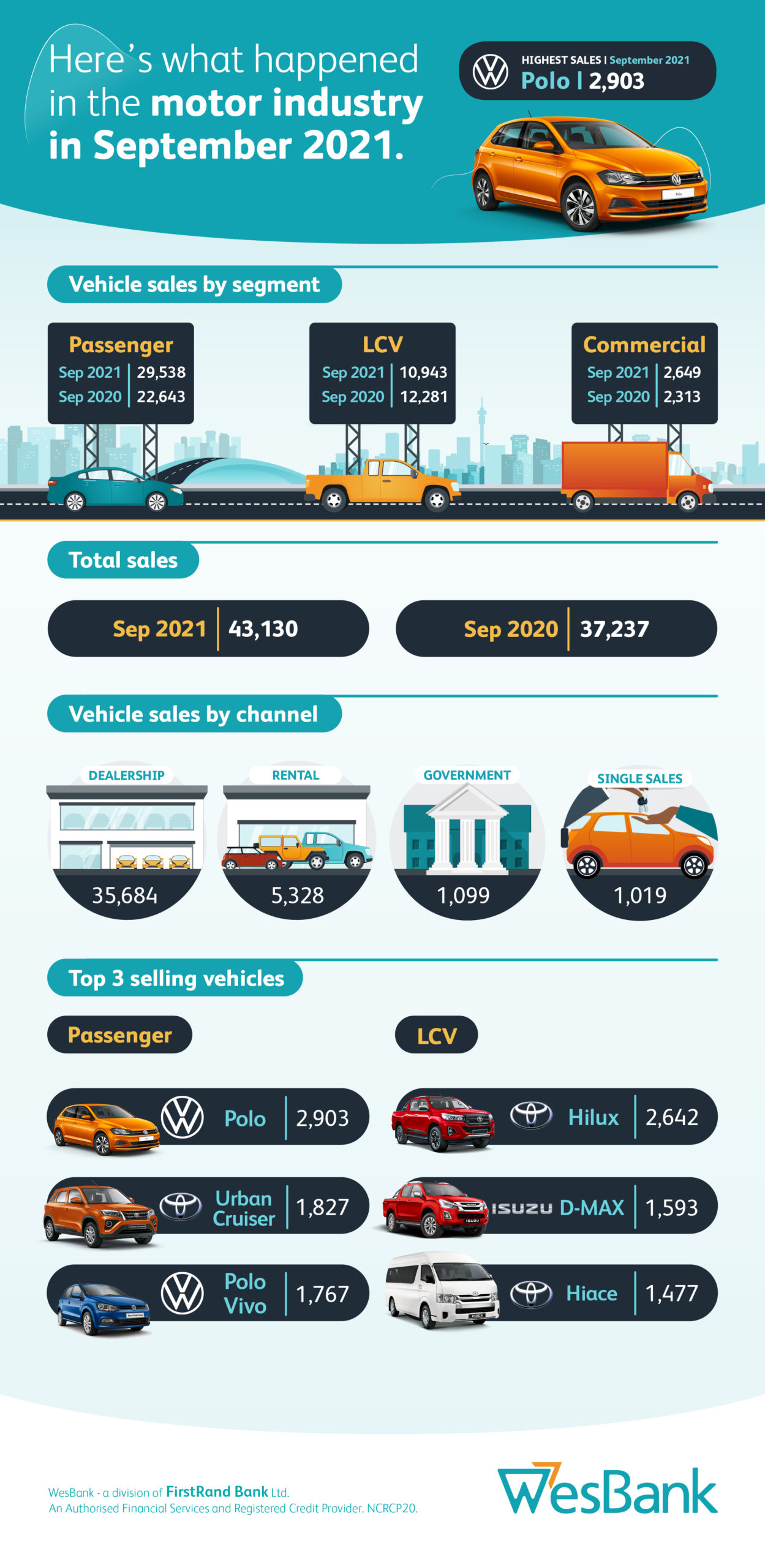

According to naamsa | the Automotive Business Council, September new vehicle sales increased 15.8% to 43,130 units compared to the same month last year. More reflective of actual performance, the month’s sales were up 4% relative to August sales, which was the second-best sales month this year prior to September’s performance.

Although new vehicle sales are 30.1% up year-to-date to 345,172 units compared to the same pandemic-impacted period last year, WesBank continues to finance well over two used vehicles for every new vehicle.

While demand in the pre-owned market remains very strong, used car price inflation may begin impacting this momentum.

Lebogang Gaoaketse, Head of Marketing and Communication at WesBank.

The sales mix across new and pre-owned is an interesting factor impacting the sustainability of the motor retail sector during the pandemic.

“While the manufacturers are naturally focused on selling new vehicles, the pre-owned market influences brand affinity. However, on a retail level, sales are sales, whether new or used, providing mobility solutions to customers and cashflow for dealers,” says Lebogang Gaoaketse, Head of Marketing and Communication at WesBank.

There’s no denying that the motor industry is facing unusual times. What has been prevalent throughout, however, is the sector’s unfailing resilience to prevail.

“While demand in the pre-owned market remains very strong, used car price inflation may begin impacting this momentum. That demand may become more about preferential specification than affordability in a time when the trade is paying a premium on certain pre-owned models,” says Gaoaketse.

“While stock availability in the new vehicle market remains stressed, forcing some consumers into the pre-owned market, the sheer demand remains encouraging for the industry once global stock shortages are alleviated,” Gaoaketse continued.

Most impacted by that stock situation is the Light Commercial Vehicle (LCV) market. LCV sales declined 10.9% during September compared to September 2020 to record 10,943 sales. This is 802 units or 6.8% less than last month. While dealer channel sales in this segment were less affected (down 7.2%), there is a noticeable lack of Government volume (down 64%) impacting the segment.

Driving the market growth was the 30.5% gain in passenger car sales year-on-year. September’s passenger car volume of 29,538 units was bolstered by 4,951 sales into the rental market and was 8.5% ahead of last month’s market. Dealer sales also swelled 17.3%, providing that much-need sustainability injection into the retail space.

“The Reserve Bank’s decision last month to maintain interest rates will continue to provide stimulus to the market, whether new or used with both sectors’ sales ultimately contributing to the overall recovery of the South African motor industry,” Gaoaketse concluded.