Volkswagen Golf 8 R Coming To A Dealership Near You

On 25 April 2023, Volkswagen will start the sale of its most powerful hatch, the Golf 8 R, in the local market.

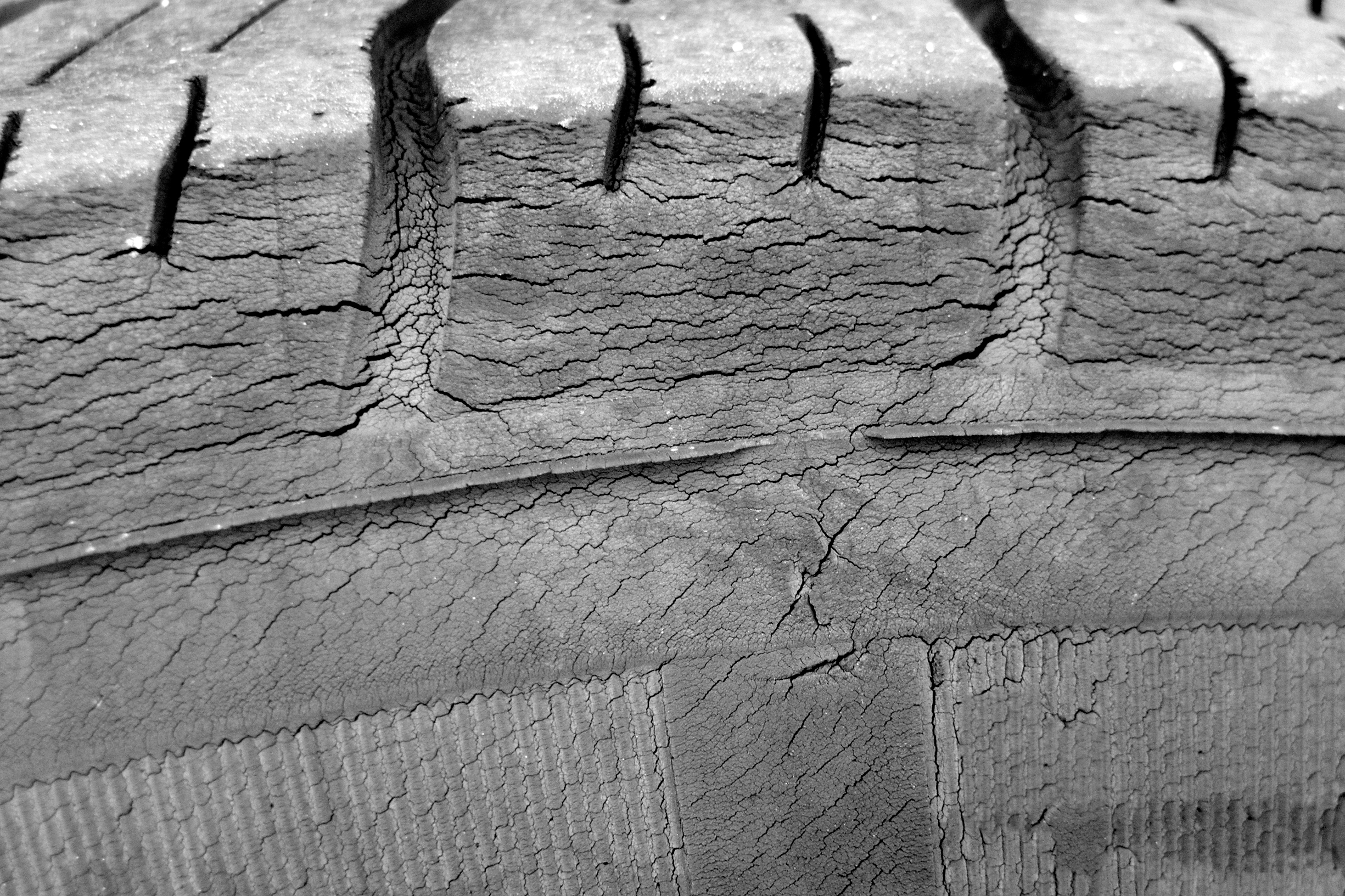

Since the Golf R’s launch in South Africa in 2007, the hatch has sold close to 6 000 units. The new Golf 8 R’s drive technology tops everything that has been launched in the Golf model range thus far. The corresponding drive output is generated by a 2.0-litre four-cylinder EA 888 engine. The new Golf 8 R accelerates to 100 km/h in just 4.8 seconds. The top speed is 250 km/h. The Golf 8 R impresses with the combination of 400Nm of torque, cutting-edge running gear and the most progressive all-wheel drive in its class.

Standard features in the Volkswagen Golf 8 R include mobile inductive charging, panoramic sunroof, keyless entry with safelock, ‘Discover Pro’ navigation system, Wireless App-Connect and Voice Control, 19-inch Estoril alloy wheels, Adaptive Chassis Control including driving profile selection, Light and Vision Package including light assist, Nappa leather R sport seats as well as a choice of three exterior colours (Pure White, Lapiz Blue metallic and Deep Black Pearl).

Optional features in the Volkswagen Golf 8 R include IQ.Light LED Matrix headlights, Akrapovič R Performance exhaust, Head-Up Display, Harman Kardon sound system, Parallel Park Assist, Rear Assist with a rear view camera, Blind spot monitor with Rear Traffic Alert, Lane Assist and electronically folding side mirrors, Travel Assist with Lane Assist and Adaptive Cruise Control, Adaptive Cruise Control with Front Assist, Autonomous Emergency Braking System as well as the Black Performance Package (includes drift mode, an increased top speed of 270 km/h and black 19-inch Estoril alloy wheels).

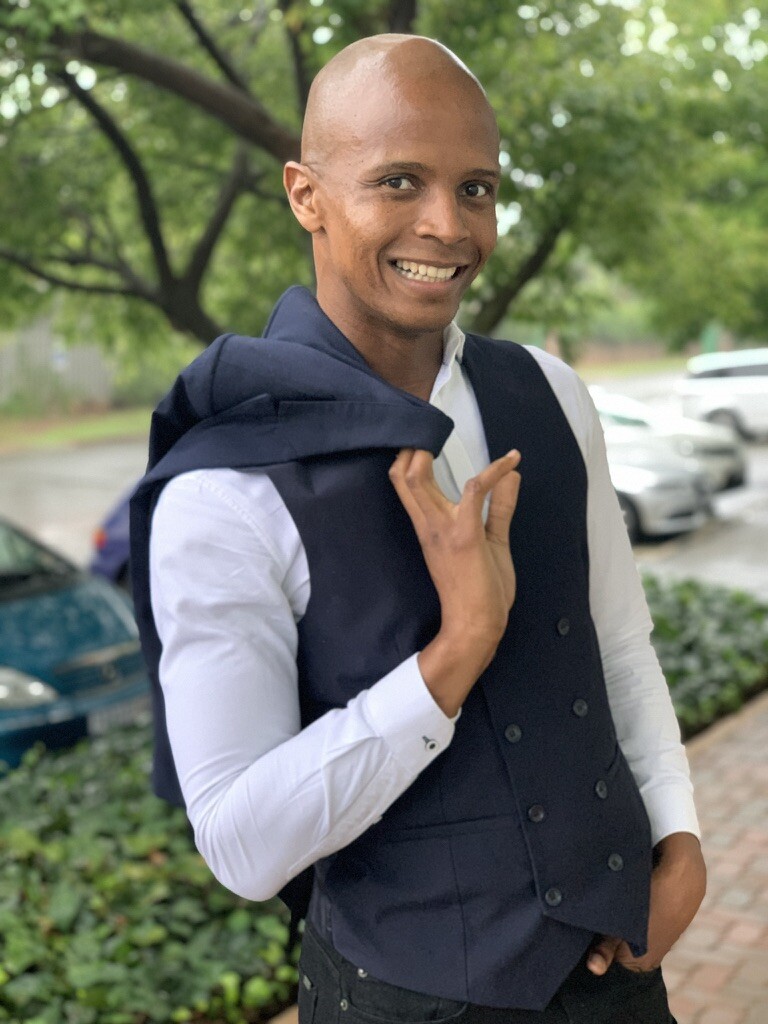

“Production constraints and parts shortages severely derailed our launch plans, but we are excited to finally extend the performance range in South Africa with the introduction of the new Golf 8 R. The Golf 8 R joins the Golf GTI and the Tiguan R as Volkswagen’s performance derivatives in the South African market,” said Steffen Knapp, Head of the Volkswagen Passenger Cars brand.

Recommended Retail Price (VAT and emissions tax included)

Golf R 2.0 TSI 235kW DSG® R912 800

The Golf 8 R also comes standard with a 3 year/120 000km warranty, 5 year/ 100 000km EasyDrive Maintenance Plan and a 12-year anti-corrosion warranty. The service interval is 15 000km