By H&H Admin

The new vehicle market continued to surge ahead during February, recording its best sales month since March last year.

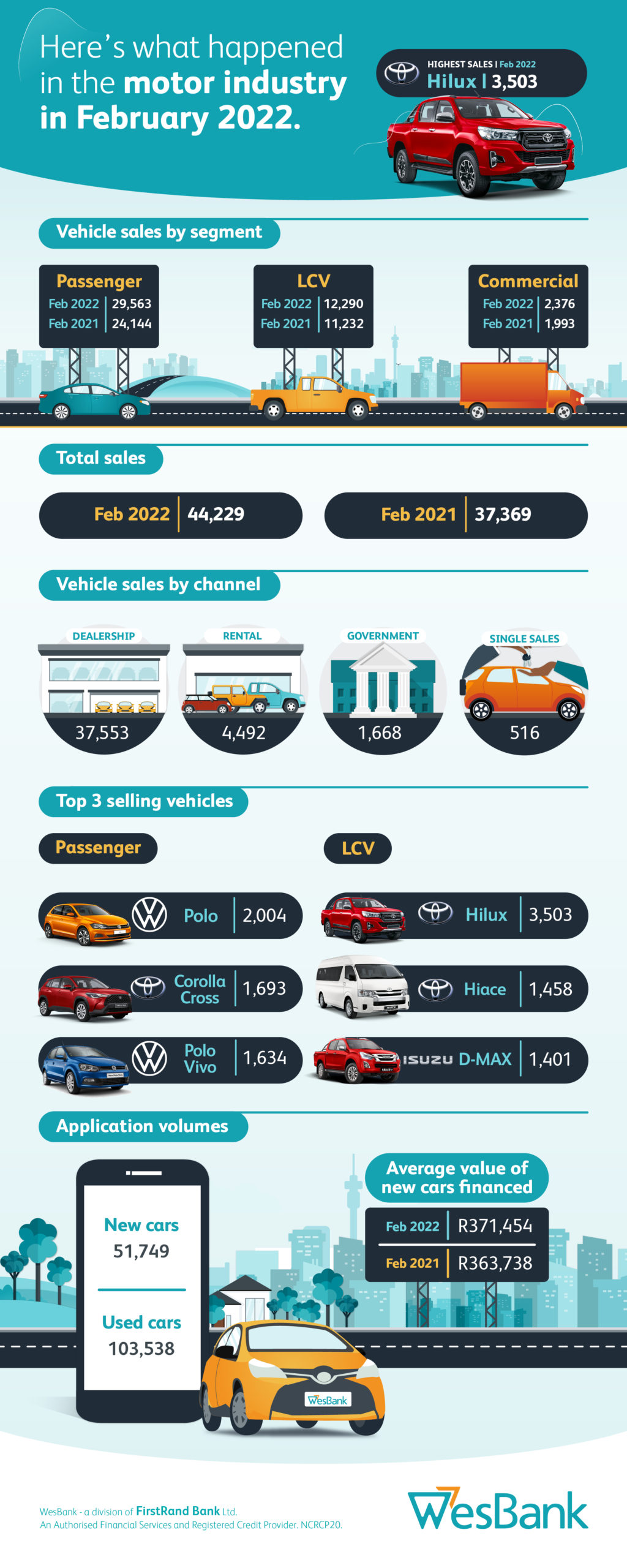

According to naamsa | the Automotive Business Council, February new vehicle sales grew 18.4% compared to February 2021 to 44,229 units, a performance approaching volumes realised during the second half of 2019.

“Despite the traditionally short February selling month and in the face of interest rate hikes and fuel price increases, new vehicle sales performed reassuringly well during the month,” says Lebogang Gaoaketse, Head of Marketing and Communication at WesBank. “Consumer demand was strong during February, particularly for new vehicles as opposed to used, borne out by WesBank’s 14.2% increase in finance applications for new vehicles alone.”

That activity was particularly strong on the passenger car dealer floor, sales through that channel growing 27.9% during February, well ahead of market growth. Overall passenger car sales grew 22.4% to 29,563 units with a slightly flatter performance from the rental market this month.

Light Commercial Vehicles were up 9.4% to 12,290 units compared to February last year.

“Although year-on-year growth during February looked inspiring, passenger car sales were actually marginally (463 units) down on January sales,” says Gaoaketse. “Light Commercial Vehicle sales during February, however, were 2,666 units or 27.7% ahead of January, likely as a result of erratic supply continuing to hamper the market.”

The market has further headwinds to face as fuel prices will exceed R21 per litre inland during March and are destined to rise further amidst tensions in Ukraine. Industry could also face additional complications over and above microchips as supply and manufacture is potentially disrupted in the region and Russia.

“The situation could amplify the divide between consumer and business demand and the market’s already hampered ability to supply,” says Gaoaketse.

“This increasing amount of pent-up demand may only be balanced by affordability considerations thanks to increased running costs, and household incomes, which remain under pressure.”

It’s a far better situation to be in than weak economic activity and the market is rejoicing thanks to increased activity in sales with the consequent ripple effect throughout the value chain.

The new vehicle market is already 18.8% up to 85,559 units during the first two months of the year compared to the year-to-date performance of 2021, outrunning many forecasts already made for the market this year.

“This bodes well for the continued recovery of the new vehicle market,” concludes Gaoaketse.