The Truth About Vehicle Finance Balloon Payments

When it comes to vehicle finance, balloon payment deals are possibly the most commonly misunderstood of all installment-type payment options.

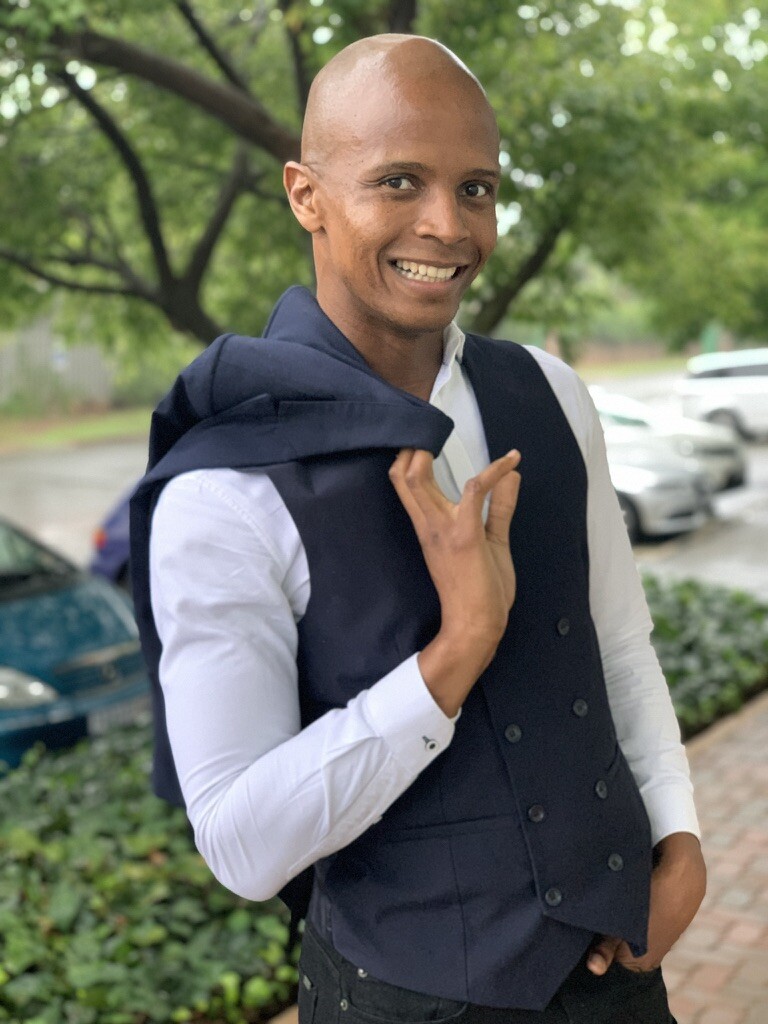

In this article, Lebogang Gaoaketse, WesBank’s Head of Marketing and Communication sheds light on the subject of balloon payment deals and shares advice for consumers considering this type of repayment option for their next car purchase.

Q : What is a balloon payment deal?

Lebogang Gaoaketse : When taken at face value, balloon payment deals may seem like an easy way to drive a car you simply cannot afford. You’re basically taking an amount owed on the purchase price of a car and setting it aside, in turn making monthly instalments lower because they are calculated on a smaller initial debt owed to the bank. It’s important to remember, however, that the amount set aside at the start of the deal is still the buyer’s responsibility and will need to be settled.

Q : What are the benefits associated with balloon payments?

Lebogang Gaoaketse : Balloons are designed to help ease the burden of monthly expenses, but the luxury of lower repayments every month does come with a great deal of responsibility for the buyer. When used correctly, the money saved on repayments should more than cover the costs of a loan needed to refinance the lump sum of debt at the end of a balloon term. Put simply, customers should aim to reserve the money they save every month in order to make settling the outstanding amount owed on a vehicle easier after years of driving it.

Q : Saving money isn’t easy even at the best of times but why is there an emphasis on savings when it comes to balloon payment deals?

Lebogang Gaoaketse : Extremely responsible budgeting is key to maximising the benefits of a balloon deal, so if you know you might struggle with saving money every month, then this option is probably not the best one for you.

There is a big difference between being able to afford driving a car and being able to afford owning it. We advise customers to consider much more than only monthly repayments when calculating vehicle finance affordability. While installment amounts may seem like the bottom line, other responsibilities such as fuel, insurance, tyres, regular upkeep, unrelated living expenses and, in the case of balloon payments, that all important lump sum owed also needs to be taken into account when looking at affordability.

Q : We often hear the term ‘breakeven point’. Tell us what it is and how it becomes a factor when financing a vehicle.

Lebogang Gaoaketse : Breakeven points are critically important to understand. A breakeven point occurs when a financed vehicle’s trade-in value falls in line with the amount still owed to the bank. Depending on the finance deal structure, a breakeven point may come sooner or later during your term, with sooner always being the goal. By nature, balloon payments will push your breakeven point to a later date within a loan period.

South African drivers have an unhealthy tendency to upgrade their vehicles and enter new finance deals more often than is financially viable. Rolling outstanding debt into a new purchase, or in other words, paying off a portion of your old car while driving your new one is a dangerous trap to fall into. Irresponsible buyers who do this multiple times not only push their breakeven point very far out of reach, but in extreme cases can owe the bank an amount that is more than what their asset, or car, will ever be worth.

It’s also important to not see a balloon payment as an alternative to a deposit put down at the start of a loan. A healthy deposit on a new or used car will always make your financial road an easier one to travel, as repayment costs and the deferred balloon debt will be lower.

WesBank strongly advises keeping monthly repayments, the value of a current car, and balloon debts evenly balanced.